The Cost of Quality (COQ) business model describes a method of increasing profits without increasing revenues.

Here’s how it works: COQ increases profit by shrinking business costs. If your business has a 5% profit margin, for example – and you decrease costs by 5% – you’ve doubled your profits. That’s simple enough, but how do you decrease costs?

COQ identifies the importance of shrinking costs without taking the usual cost-cutting measures like not buying everyone’s favorite pens or not stocking refreshments in the break room — the “let’s avoid morale buzz-kills to save a few bucks” approach to increasing profit. Instead, COQ promotes lessening mistakes and increasing business process efficiency.

Companies adopt and tweak COQ to reflect their business goals and in turn their profitability. The model applies to not-for-profit businesses too: budgets are tight; grants, revenues, or contributions may not increase, but the same valuable services need to be delivered with less and less money, right?

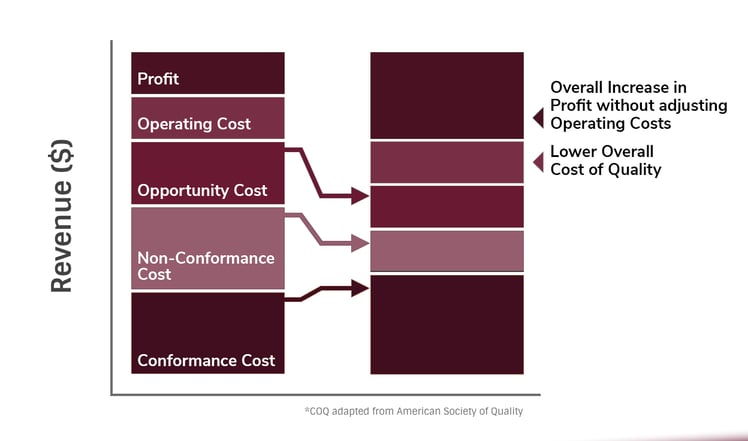

COQ is made up of three elements: conformance costs, non-conformance costs, and opportunity costs. We’ll explain these before we explain the rest of what the graphic illustrates:

Conformance Costs

|

|

|

Non-Conformance Costs

|

|

|

Opportunity Costs

|

Notice these three cost categories are not associated with the cost of producing the output. Materials needed to assemble a product (labor, supplies, etc) are not included. The three elements merely reflect the costs associated with the business process. As we always say, “the profit’s in the process.” The efficiency of your business processes determines your efficiency as a business. If you’re going to maximize your efficiency and profitability, you need a sound understanding of the cost of quality.

Think about it: the process is where value is added and where profit is made. Consumers don’t squeeze oranges to make juice anymore. Okay, maybe on rare occasions, but who cuts down trees and processes timber as a raw material to make paper?

The cost of quality is associated with the cost incurred to ensure process outputs (products and services) meet customer requirements. For example, let’s say Company A manufactures pens, a process that takes ten steps to complete. About half of the time, the process works effectively, and high-quality pens are made. The other half of the time, however, is plagued by faulty manufacturing— lackluster execution in the assembly process. As a result, Company A has to keep half of its pens in its shop for a bit longer for fixing/repairing, incurring non-conformance costs. This leads to a lack of consistency. Ultimately, this waste is passed onto the customer with an increased price per unit and/or inferior product— making it more and more difficult to compete.

That’s why COQ’s biggest cost adjustment occurs in reducing non-conformance costs— tightening the process and ensuring customer requirements are met. This may require spending extra money to do some work over again.

Now, to run through the graphic:

- Conformance costs are important and help ensure a business’s success and stability. when optimizing your business, conformance costs should stay the same or in many cases increase.

- Non-conformance costs, as we’ve mentioned, need to drop significantly— though you can never expect to be without them, strive to get rid of them.

- Opportunity cost is the value of the next best choice. It’s the “what could have been.” If a business is suffering from non-conformance costs, the “what could have been,” is higher in the left portion of the graphic, where non-conformance costs are much higher. If a business is succeeding financially, there is little “what could have been,” therefore reducing the opportunity cost.

- Operating costs are constant. They’re the costs of a business building, utilities, licenses, etc— which fluctuate, but are not enough to factor into this model.

- Profit looks like this: $$$. Reducing non-conformance generates more $$$.

So, how do you reduce non-conformance? Remember: the $$$’s are in the process.